Value of Money for Kids: Science, Stories & Strategies to Teach True Worth

- The Sirius Academy

- Jul 16

- 2 min read

Table of Contents

Why Money Feels Different to Kids

Scarcity: The Power of “Limited”

Utility: When Money Solves Problems

Social Proof & Status

Emotion + Memory

Real‑World Application Activities

Key Takeaways

FAQ

Why Money Feels Different to Kids

Kids aren’t born with price memory or market logic. Their sense of value comes from stories, social signals, and the emotions adults attach to objects and experiences.

Quick stat: Research shows that children begin forming money‑related habits as early as age seven (University of Cambridge). That means the earlier you start, the better.

1. Scarcity: The Power of “Limited”

From Pokémon cards to limited‑edition sneakers, scarcity is a magnetic force. When kids realize that something won’t always be available, its perceived worth skyrockets. Use classroom auctions or time‑bound challenges to demonstrate how rarity drives demand.

Activity

Give each student five “resource tokens” and auction classroom privileges—seat choice, extra recess minutes, or bonus hints. Afterwards, discuss why bids escalated when items were few.

2. Utility: When Money Solves Problems

Value soars when an item solves a tangible problem. Explain why a simple umbrella is worth more during a downpour, or why a laptop charger feels priceless before a deadline.

Classroom Hack

Let students “buy” extra hints during a quiz using points earned from good behaviour. They learn trade‑offs between spending now versus saving for future challenges.

3. Social Proof & Status

Teen fashion trends show how peer approval multiplies value. When everyone in class wants the latest phone, its price tag becomes secondary to the social signal it sends.

Discussion Prompt

Ask students why influencers can sell out a product within hours. Is it the product itself or the crowd behind it?

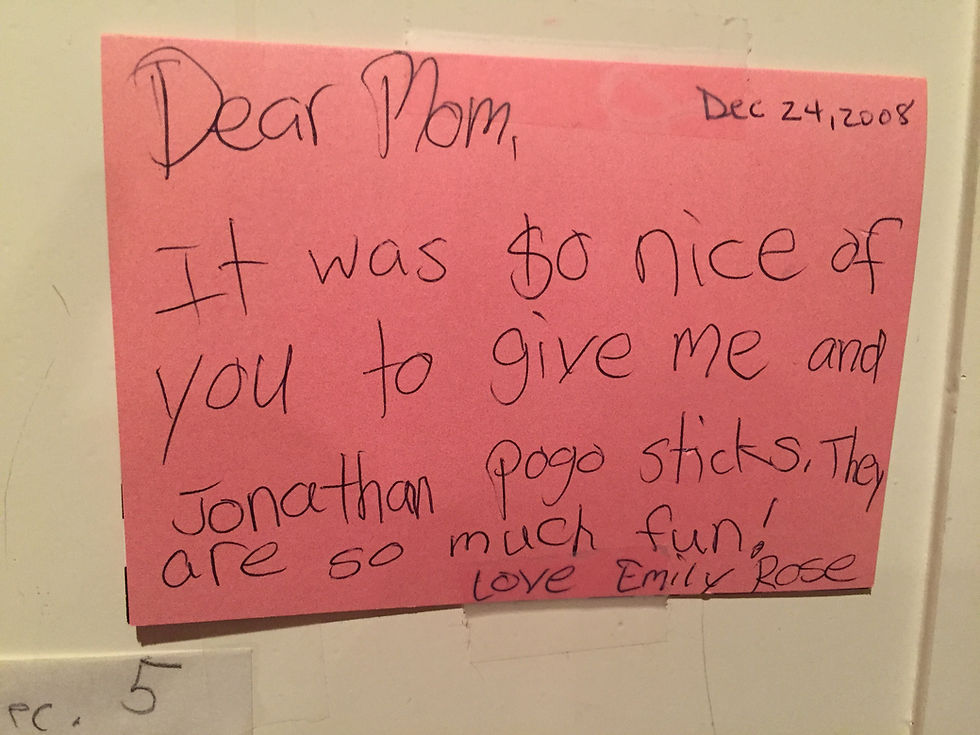

4. Emotion + Memory

A handwritten birthday card can feel priceless while costing next to nothing. Emotional resonance often outweighs material cost, teaching kids that sentimental value can trump price.

Home Extension

Encourage learners to list three items at home that hold sentimental value and share the stories behind them.

5. Real‑World Application Activities

Activity | Skills Practiced | Prep Time |

Pocket‑Money Journal | Budgeting & reflection | 10 min |

Mini Stock Market Game (use Mad Money issue #14) | Risk vs reward | 15 min |

Needs‑vs‑Wants Photo Hunt | Decision making | 5 min |

Key Takeaways

Scarcity, utility, social signals, and emotion drive perceived value.

Start teaching with relatable, sensory examples.

Reinforce lessons through action, not lectures.

Ready‑Made Classroom Pack

Our Mad Money book set (₹999/-) bundles stories, games, and printable activities that do the heavy lifting for you.

Frequently Asked Questions

Q1. What age is “too early” to talk money? Even preschoolers can grasp basic trade logic by swapping game tokens.

Q2. How do I keep lessons fun? Gamify everything—points, challenges, leaderboards. Mad Money includes built‑in reward systems.

Q3. Can these activities align with NEP 2020? Yes. They tick boxes on experiential learning, competency‑based education, and life skills.

Comentários